Ezoic Payment Methods: How To Choose The Best

- How Ezoic Pays Publishers

- Minimum payout threshold

- Withdrawal methods

- Features of each method: Nuances, pros and cons

- WISE (formerly TransferWise): Low cost currency transfer with multi currency accounts

- Direct bank transfer (US only)

- Check (for USA and Canada)

- International bank transfer via Payoneer

- Payoneer prepaid card

- PayPal

- Which payment method to choose

- Terms of enrollment

- Frequently Asked Questions

Ezoic is an ad testing platform that allows you to test ad placement and layouts for different types of ads from different ad networks on your site. Ezoic pricing pleasantly pleases its users with different levels and tariff plans.

The Ezoic system offers site owners different ways to withdraw funds. Some of them are available only in the USA, some in almost any country. Let's take a closer look at each of these methods.

How Ezoic Pays Publishers

The company operates on a 30-day schedule. Therefore, usually money can be withdrawn within 30 days after they were credited to the account.

For example, you can receive funds earned in January at the end of February.

As a rule, payments are made from the 27th to the 31st of each month.

However, in the terms, the company indicates the period not 30 days, but 45 days. This means that 45 days is the maximum waiting period for receiving the earned money. This circumstance is due to the work of various ad networks with which Ezoic cooperates. There are more than a hundred of them. And each has its own terms of payment. A 15-day increment allows the site to detect inconsistencies and fix problems.

The company itself writes on its website that 30 days to receive funds is the norm, and 45 days is the absolute maximum.

To start withdrawing funds, you need to fill in your tax details and choose the appropriate method of receiving money. We will talk about the latter further.

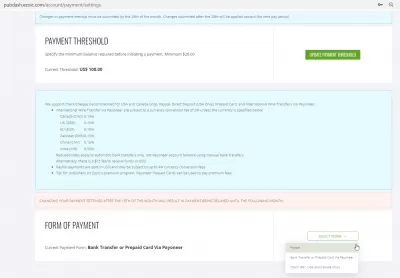

Minimum payout threshold

The minimum threshold for withdrawing earned funds is $ 20. This is especially beneficial for small and new sites that make little money.

However, if desired, the user can set the payout threshold himself by making it higher. For example, if you pay an additional commission for a transfer, sometimes it is more profitable to withdraw rarely and in large amounts than often and little by little.

For comparison, Google Adsense has a minimum threshold of $ 100.

Withdrawal methods

Ezoic offers the following options:

- WISE low fee transfer. Best payment method - for selected countries.

- Payment by check. For US and Canadian citizens only.

- Direct transfer to a bank account. Available to US residents only.

- Payoneer prepaid card. Available in most countries. For Russians and Ukrainians - including.

- International bank transfer. The Payoneer system is used. Available in most countries.

- PayPal. Available in most countries. There are a number of restrictions for Ukraine.

Funds are credited in dollars. Therefore, there may be a slight difference in commissions when converting.

Features of each method: Nuances, pros and cons

Let's take a closer look at each of the methods. Commissions, terms, disadvantages and advantages.

WISE (formerly TransferWise): Low cost currency transfer with multi currency accounts

The best solution to receive money generally is the free WISE multi currency account in which there is no maintenance cost, and no fees hidden in conversion costs.

Let’s see an example of a $2000 monthly earnings money transfer that has then to be converted from US Dollars to Euros for local spending:

- With PayPal: $2000 transferred, 3% transfer fee to PayPal, $1940 on PayPal account. Transfer to EUR bank account with 4% conversion fee, result in $1,862.4 received in local EUR currency.

- With Payoneer: $2000 transferred, $3 paiement fee and $3 monthly maintenance cost, $1994 on Payoneer account. Transfer to EUR bank account with 1.5% conversion fee, result in $1,964.09 received in local EUR currency.

- With WISE: $2000 transferred, no fee, $2000 on WISE account. Transfer to EUR bank account with 0.5% conversion fee, result in $1,990 received in local EUR currency.

Therefore, WISE is the preferred option to receive an Ezoic (or any international payment for that matter) in local currency.

There are no maintenance fee, the 0.5% transfer fee is transparent, and the exchange rate applied is the market rate, as they are not hiding fees in this transfer rate. The only fee ever is to receive a debit card if you chose to, in which case you’ll be charged a $5 posting fee – but that’s the only fee ever!

- Transparent conversion fees

- Market conversion rate

- No maintenance cost

- Simple and free

- Only accessible to selected countries

Direct bank transfer (US only)

In this case, Ezoic will simply transfer the money to your bank account. The size of the commission varies depending on the bank. However, they are usually minimal or absent.

The term of enrollment is from one to several days.

- quick and easy

- no need to register with third-party systems

- only available in the USA

Check (for USA and Canada)

A bank check is a security that is used in non-cash payments. It indicates the amount and the order of the drawer for its issuance to a specific person.

After receiving the check, you need to personally come to the bank branch and cash it. You must have a passport with you. This cashing procedure is called collection. The bank employee will check the data and issue the money.

Usually a commission of 1-3% is charged for collection. However, in some banks it can go up to 5%.

The term of receipt is several days.

- you can not use the card

- only available in the USA and Canada

- there may be a large commission

- additional cashing procedure is required

International bank transfer via Payoneer

Funds are transferred via Payoneer. The method is available in most countries. Including in Russia and Ukraine. However, you first need to register an account with Payoneer.

Additional fees apply for currency conversion. Its size varies depending on the type of currency:

- for the Canadian dollar (CAD, Canada) - 0.15%;

- for the British pound (GBP, UK) - 0.15%;

- for the euro (EUR, EU countries) - 0.15%;

- for Pakistani rupees (PKR, Pakistan) - 0.15%;

- for yuan (CNY, China) - 0.15%;

- for Indian rupees (INR, India) - 0.5%.

For all other currencies, the conversion fee is 2%. Including for the ruble.

By the way, an additional commission is charged for receiving funds in dollars. Its size is $ 15.

The term of enrollment is from one to several days, depending on the country.

- available in almost any country (also in Russia and Ukraine)

- quickly

- reliable and safe

- small commissions

- registration with Payoneer is required

Payoneer prepaid card

Available in most countries. Including in Russia and Ukraine.

However, in order to issue such a card, you must contact Payoneer directly. You cannot do this through Ezoic. In Ezoic, you can only later specify your card details in the settings.

You simply draw up a card (this can be done online) and indicate its details in your Ezoic account.

- available in almost any country (also in Russia and Ukraine)

- quickly

- reliable and safe

- small commissions

- registration with Payoneer is required

PayPal

This withdrawal method is available in most countries. Including in Russia. For citizens of Ukraine, PayPal functionality is limited: funds can be used to pay for purchases on foreign sites, but you cannot withdraw money to cards of Ukrainian banks.

Since payments are received in US dollars, they may be subject to currency conversion fees. In PayPal, it can go up to 4%.

- available in almost any country (also in Russia)

- quickly

- registration with PayPal is required

- limited functionality for citizens of Ukraine

- unreliable

- large commissions

Which payment method to choose

For US residents, direct bank transfer is the easiest and most profitable method. It is fast, reliable and as cheap as possible. You can also use a Payoneer prepaid card, as wire transfers in the United States are free of charge with this system.

For Canadian citizens, it is more convenient to choose a check or Payoneer prepaid card.

For Russian citizens, the most accessible are two methods: withdrawal to a PayPal wallet or international bank transfer via Payoneer. The first method (PayPal) is faster and more convenient. However, there are high conversion fees here. In addition, the work of PayPal for Russians is not always reliable, since the site regularly introduces restrictions on the use of funds, then cancels them. So the second method (Payoneer bank transfer) is safer and also more profitable in terms of fees.

For residents of Ukraine, the most convenient international bank transfer through Payoneer or their prepaid card. However, if you do not plan to withdraw funds from the Internet and will only spend them online in foreign stores, you can safely choose PayPal.

In European countries, it is better to use PayPal, international bank transfer or Payoneer prepaid card.

Payoneer prepaid cardIf you are not using USD as your main currency, it might be better to get Ezoic payments on a Payoneer prepaid card, and to then transfer USD to EUR or to your favorite currency using an external low cost money exchange service such as Transferwise or Revolut.

USD to EUR money transfer information and low fee solutionsTerms of enrollment

Funds usually arrive within 1-2 days. However, a lot depends on the specific payment system.

In general, Payoneer is the safest and most profitable method. There are low commissions, and you are guaranteed to receive the earned funds.

Frequently Asked Questions

- When does Ezoic pay?

- Officially, Ezoic allows you to withdraw money within 30 days after they are credited to your account. As a rule, payments are made from the 27th to the 31st of each month. But the company writes on its website that 30 days to receive funds is the norm, a

- What is the minimum amount that can be withdrawn from Ezoic account?

- The minimum threshold for withdrawing earned funds is $20. This is especially beneficial for small and new sites that earn little. However, if desired, the user can set the payout threshold by increasing it. For example, if you pay an additional transfer fee, sometimes it is more profitable to withdraw infrequently and in large amounts than often and in small amounts.

- What are the different payment methods offered by Ezoic, and how can publishers select the most suitable option?

- Ezoic offers payment methods like PayPal, direct bank transfer, and check. Publishers should consider factors like transaction fees, ease of access to funds, and processing times when selecting the best payment method for their needs.